Vice Provost Laurent El Ghaoui’s Research Among Top-Ranked in Operations Research Journal

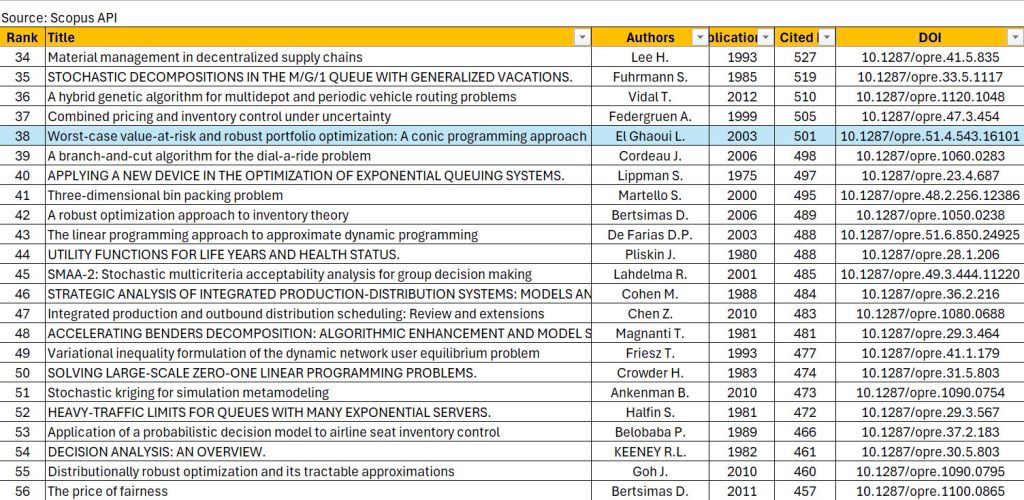

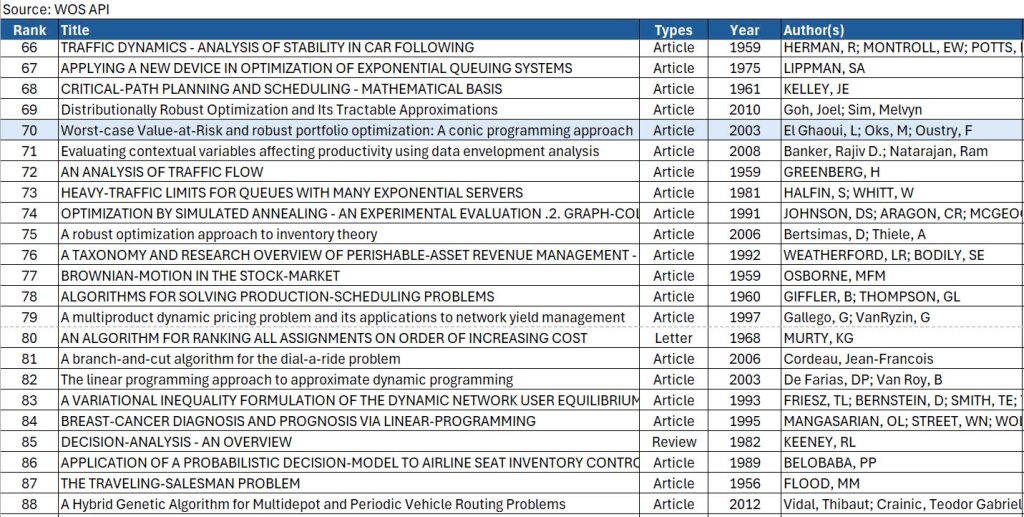

We are pleased to recognize the impact of a 2003 paper by our Vice Provost, Laurent El Ghaoui, titled “Worst-case Value-at-Risk and Robust Portfolio Optimization: A Conic Programming Approach.” As of November 9, 2024, this work is ranked 38th in Scopus and 70th in Web of Science among all publications in the Operations Research journal (Q1-rated by SCImago).

In this study, Prof. Laurent El Ghaoui and his co-authors addressed a key challenge in portfolio optimization: the sensitivity of traditional approaches like mean-variance and Value-at-Risk (VaR) to data errors. By using only partial information, such as bounds on mean and variance, they developed a method for calculating and optimizing a “worst-case” VaR. This approach provides a practical solution for managing risk amid uncertain data.

We thank our Vice Provost for his ongoing contributions!

![[Job opportunity] Finance Support Officer](https://vinuni.edu.vn/research/wp-content/uploads/2025/12/DSF3880-300x207.jpg)